Cohabiting Couples: The Need To Have A Will & Why It Is Important

6th May 2020 by Kevin Karue

Origins of Marriage

The first recorded evidence of marriage ceremonies uniting one woman and one man, dates from about 2350 B.C., in Mesopotamia. Over the next several hundred years, marriage evolved into a widespread institution embraced by the ancient Hebrews, Greeks, and Romans. According to Stephanie Coontz, author of “Marriage, A History: How Love Conquered Marriage”, for the Anglo-Saxons and Britain’s early tribal groups, marriage was seen as a strategic tool to establish diplomatic and trade ties; people established peaceful relationships, trading relationships, mutual obligations with others by marrying them. Of course, through marriage, biological heirs were more easily known. Mostly.

Love was never really factored into the marriage equation; roaming bards sang of love during medieval times and Shakespeare’s Romeo and Juliet acted it out on stage, but it wasn’t until the Victorian era that love became accepted as a foundation for marriage based on love or companionship.

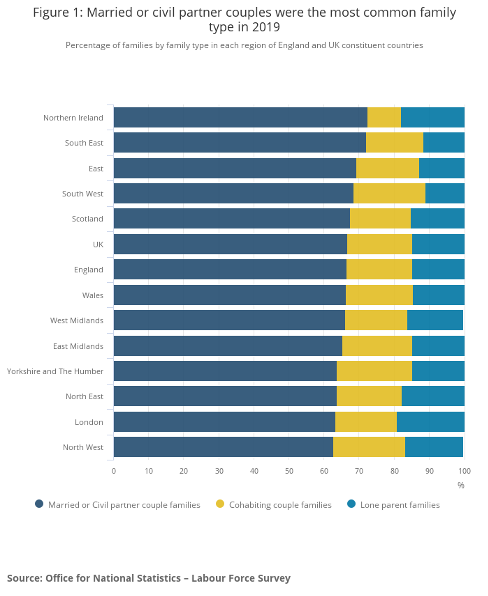

Since the introduction of marriage, it became and continues to be the most common set up for the family unit. According to the latest data gathered by the Office for National Statistics (ONS), there were 19.2 million families in the UK as of August 2019; this is a statistically significant increase of 6.8% over the last decade. Marriages/Civil Partnerships remained the most common family type in 2019, representing two-thirds of all families (12.8 million). Cohabiting couples were the second-largest family type at 3.5 million (18.4%), followed by 2.9 million (14.9%) lone parent families. In the UK over the last 10 years, the proportion of families containing a cohabiting couple increased from 15.3% to 18.4%, indicating a rising number in the years to come and perhaps a sign that more families may yet adopt this model.

How Does The Law on Inheritance Affect Cohabiting/Unmarried Couples?

The statistics gathered by the ONS, as illustrated above in the chart, confirm the growing popularity of cohabiting couples as a family unit. As the law stands today, cohabiting couples are at a significant disadvantage compared to their peers who are married. For example, marriage allowance, the right to pensions, benefiting from an estate where no Will was in place etc., are all examples of scenarios where the partner in a married couple is automatically entitled to benefit. In England & Wales (Scotland has made some adjustments to the rights for cohabiting couples), cohabiting couples do not benefit from such schemes and there is a common misconception that the rights for unmarried couples are the same or similar to those who are married/in a civil partnership, upon intestacy (an estate where no Will was prepared).

For some time now, Parliament has been working towards creating a law to finally bring into force legal rights for cohabiting couples that align with those created through a marriage/civil partnership. The Cohabitation Rights Bill 2017–19 is a Bill to provide protection to financially disadvantaged cohabitants and to make provision for them on the death of their partner. The Bill would provide protection for cohabitants who have lived together for a specified period of time (maybe two or three years) or who have a child together, the right for either partner to apply to a court for a financial settlement order upon the breakdown of the relationship to redress a financial benefit, and the right to their partner’s estate under the intestacy rules.

Despite various readings and amendments suggested throughout the Bill’s journey through Parliament, it is yet to be finalised. Family units have dramatically changed over the centuries; from the origins of marriage where the marriage was a tool to organise life, to the norm of today where cohabiting is a choice that people make, it is right that these couples have their rights protected by law.

About 3.5 million couples have chosen to set up their family units in this way, which represents a significant portion of estates where close family members in those units, particularly partners, stand to not inherit anything due to how the law is currently in force. The only legal remedy that can be taken and that is in everyone’s control, is making sure you have a Will in place with the same sentiment being applied to having a Power of Attorney. To illustrate the point, below is a fictional family’s estate quantified into some relatable figures which can help illustrate what goes wrong when cohabiting couples do not have a Will.

Factual Summary

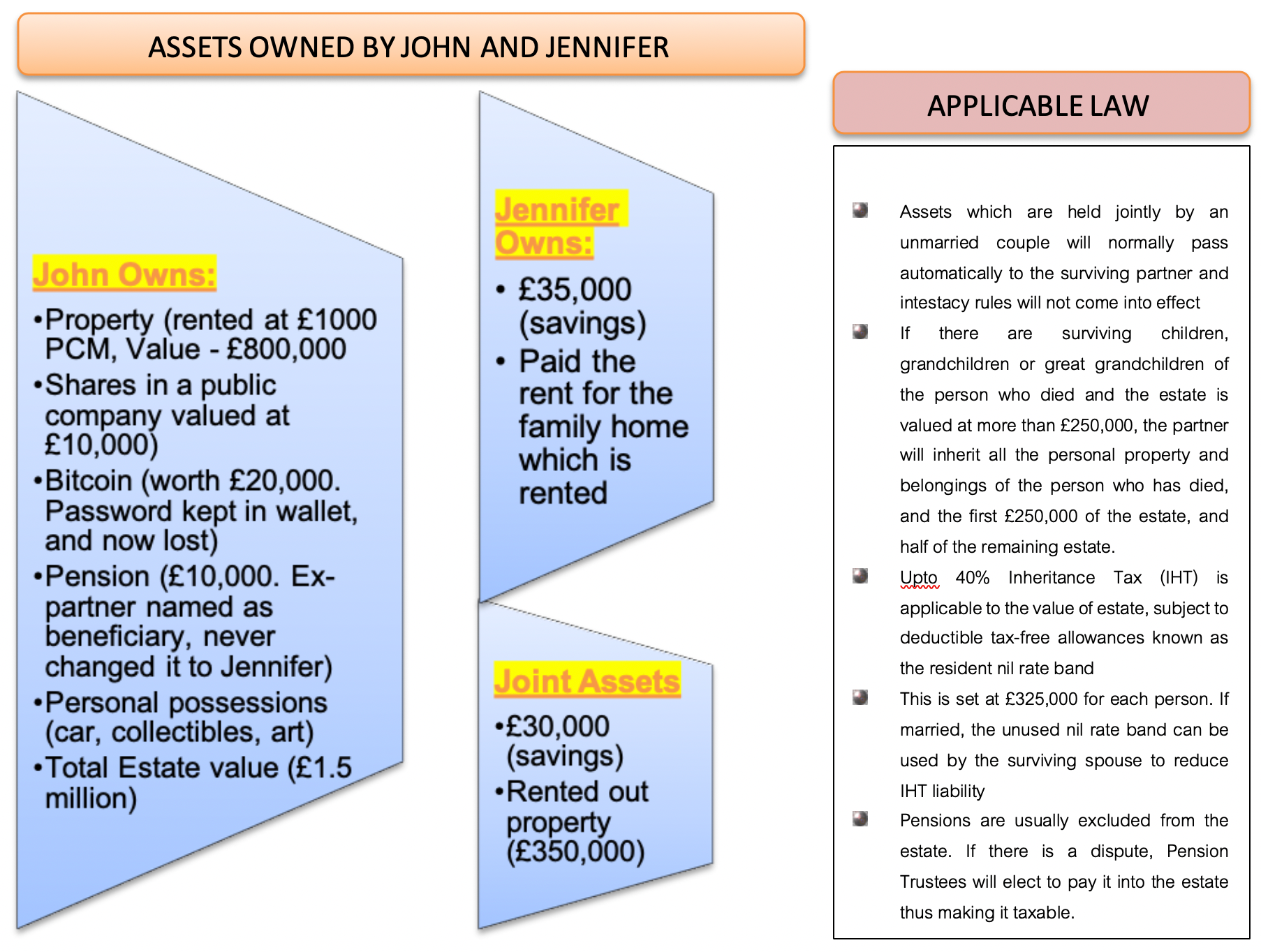

John and Jennifer are unmarried and have been cohabiting for five years. They have two beautiful young children: Kyle and Lily. John works in Finance and is the main breadwinner since Jennifer took time off work to care for the children.

Their assets, in sole and joint names, are shown below. They have been planning a wedding for some time and have agreed to set a date soon. Neither John nor Jennifer have a Will in place. John still has his ex-partner named as the beneficiary of his pension as he has not managed to make time to speak to the pension provider and put down Jennifer as his beneficiary. The scenario includes an analysis of what would happen upon the death of either partner by comparing the differences between being unmarried/cohabiting partners versus being married/in a civil partnership.

As neither John nor Jennifer have a Will, in the event of either one’s unfortunate demise, intestacy rules would apply as follows:

· As cohabitees, the surviving partner gets:

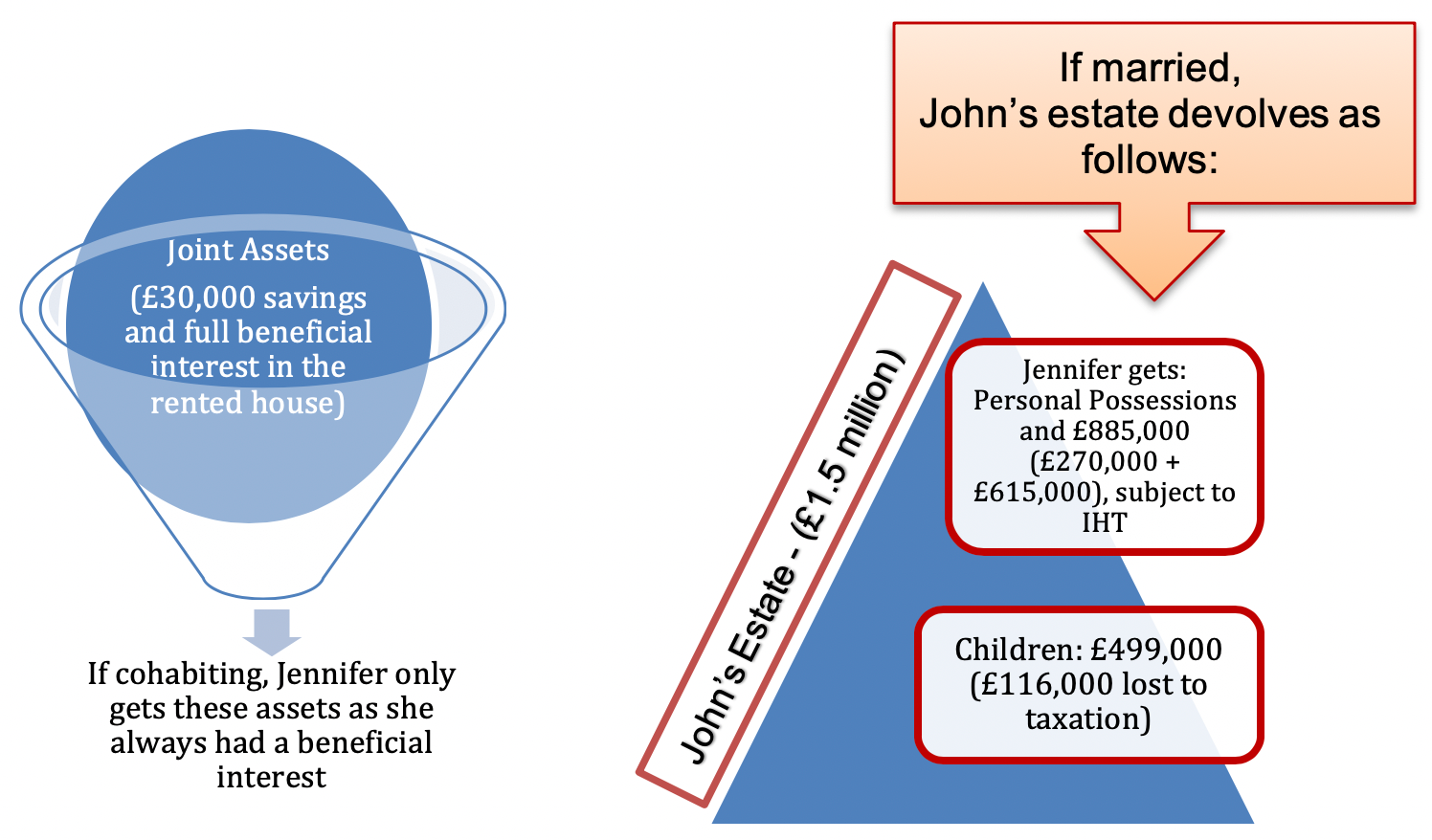

- Anything owned in joint names, passes automatically to the surviving partner. Everything else owned in his sole name transfers to the children, to be shared equally between Kyle and Lily, but held in trust for them as they are under the age of 18. The surviving partner gets nothing. For example, although Jennifer has been paying the rent for the home, this does not entitle her to anything more out of John’s estate, unless she initiates court action.

· As a married couple, the surviving spouse gets:

- Personal possessions;

- The first £270,000 (tax free) together with interest on that amount from the date of death; and

- One half of anything that remains. Their children, Kyle and Lily, will receive the other half of anything that remains. This works out as follows:

- John’s estate is worth £1.5 million. Jennifer would receive the first £270,000 tax free and one half of the remainder (£615,000). The children will receive the other half which is £615,000 held in trust for them.

- The amount passing to the children exceeds the current nil rate band allowance of £325,000. This means £615,000 less £325,000 = £290,000. Applying IHT at 40%, there is a tax bill of £116,000 levied on the amount the children would receive. This tax bill could have been deferred if both spouses had a Will leaving everything to the surviving spouse.

- In addition, the nil rate band for John is used up upon his death meaning that there is no unused nil rate band to transfer to the surviving spouse, potentially increasing the IHT on the second death (Jennifer). This negatively affects what the children could inherit due to increased tax liability.

In all cases, the Bitcoin worth £20,000 is lost forever. Further, as John did not update his pension beneficiary, either his ex-partner will benefit, or the Pension Provider Trustees will elect to pay the amount into his estate adding to what is subject to taxation (IHT).

How Does Lifeium’s Technology help with Getting A Will?

To avoid complications, it would be advisable for couples regardless of status to create a Will to provide security for their loved ones. A Will also serves to avoid inheritance tax which can be up to 40% of the value of the estate due to be inherited. As seen in the scenario above, Kyle and Lily inherit the estate by less than £116,000 due to IHT liability; there is no plausible reason to effectively disinherit a lived one whilst the cost of making a Will can be as low as about £150 through a firm of Solicitors. Echoing the words of Benjamin Franklin,

“…In this world nothing can be said to be certain, except death and taxes”.

We have good reasons to momentarily forget, or not wish to engage with our mortality, but as sure as the sun rises in the East and sets in the West, it is certain. Having a valid Will in place, protects your loved ones and spares them of the need to rely on costly and uncertain litigation processes in Court to assert their rights. Chances are most of us would not knowingly put our loved ones through such a difficult process if we know of the consequences that evolve from not having a valid Will.

Lifeium is a legal technology company powering law firms into the future of legal practice. We provide an innovative platform allowing for a modernised approach to Will creation. End-users get involved in the process through their smart phone and law firms have complete oversight over the client journey via management portal. This helps law firms stay competitive, saving them time and money, turning Legal Services into fast moving products that ultimately benefit the public.

Kevin Karue, CEO Lifeium.

*Always seek Legal Advice on matters to do with your estate. This article is not intended to act as a substitute for proper and well informed legal advice. Facts and estate figures are fictional and for illustration purposes only.